Loading... Please wait...

Loading... Please wait...- M-F 7am-5pm PST

- Contact Us

- Customer Service

- About Us

- Shipping

- Sign In

- My Account

Shop by Category

- Unique Gifts

- Office Gifts

- Gifts for the Home

- Occasions

- Valentine's Day Gifts

- Chinese New Year Gifts

- Anniversary Gifts

- Birthday Gifts

- Retirement Gifts

- Doctors Day Gifts

- Nurses Day Gifts

- Mother's Day Gifts

- Father's Day Gifts

- Baby Shower Gifts

- Bridesmaid Gifts

- Engagement Gifts

- Graduation Gifts

- Groomsmen Gifts

- First Communion & Confirmation Gifts

- Housewarming Gifts

- Memorial & Sympathy Gifts

- Thank You Gifts

- Wedding Gifts

- More Occasions

- Occupation Gifts

- Gifts for Nurses

- Gifts for Doctors

- Gifts for Dentists

- Gifts for Veterinarians

- Gifts for Actors

- Gifts for Coaches

- Gifts for Contractors

- Cosmetology Gifts

- Gifts for Engineers

- Gifts for Hair Stylists

- Gifts for Lawyers

- Gifts for Judges

- Gifts for Pharmacists

- Gifts for Police Officers

- Gifts for Priests

- 100+ More Career Gifts

- Shop by Interest

- Gifts for Women

- Gifts for Men

- Shopping Guides

- Customize Your Gift

- Color Examples

Resale Certificate Requirements for Tax Exempt Purchases

If you are located in a state requiring sales tax and are purchasing wholesale items for resale, we must have a valid, signed Resale Certificate on file in order to exempt the sale from your state's sales tax. Tax exemption form is only valid for contractors, electricians, and others intending to resell the items within their state of residence.

1. Please create an account.

2. Fill out the appropriate Resale Certification for your state. Please see links below.

3. Email us the completed and signed resale certificate form (or fax to 925-454-5364). We will review your form to validate the exemption.

4. Once approved we will notify you that your account is approved for tax exempt purchases. You must be signed into your account at the time you are placing an order for tax exempt status.

Note: purchaser must be in the business of selling the items requested for sales tax exemption for the exemption to be approved. Alternately, you may request a refund from your state at the time you file your sales taxes.

STATE RESALE CERTIFICATE FORMS

Alaska Resale Certificate Form

Arkansas Resale Certificate Form

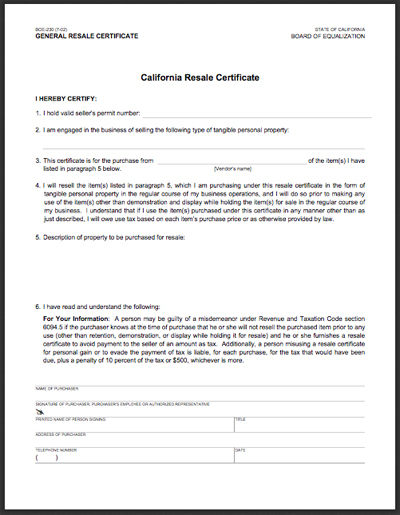

California Resale Certificate Form

District of Columbia Resale Certificate Form

Florida Resale Certificate Form (ex. of the needed DR-14 form)

Georgia Resale Certificate Form

Hawaii Resale Certificate Form

Illinois Resale Certificate Form

Indiana Resale Certificate Form

Kansas Resale Certificate Form

Kentucky Resale Certificate Form

Louisiana Resale Certificate Form

Maryland Resale Certificate Form

Michigan Resale Certificate Form

Minnesota Resale Certificate Form

Nebraska Resale Certificate Form

Nevada Resale Certificate Form

New Jersey Resale Certificate Form

North Carolina Resale Certificate Form

North Dakota Resale Certificate Form

Oklahoma Resale Certificate Form

Pennsylvania Resale Certificate Form

Rhode Island Resale Certificate Form

South Dakota Resale Certificate Form

Tennessee Resale Certificate Form

Vermont Resale Certificate Form

Virginia Resale Certificate Form

Washington Resale Certificate Form

West Virginia Resale Certificate Form

Wisconsin Resale Certificate Form

Wyoming Resale Certificate Form

Original Designs Made in USA

Original Designs Made in USA